Contact Us

Phone: 423-205-7744

Location

4416 Brainerd Rd.

Chattanooga, TN 37411

Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Call Now 24/7 Free Consultation: 423-205-7744

New Ruling U.S. Supreme Court Harris v. Viegelahn, Could Benefit Filers Converting Chapter 13 to Chapter 7 Bankruptcy

The recent Supreme Court ruling in Harris v. Viegalahn had an immediate impact on pending Chapter 13 cases and future Chapter 13 bankruptcy cases.

Bankruptcy Trustees Throughout the Nation Revise Internal Procedures

After the Supreme Court issued the Harris v. Viegalahn ruling, trustees across the nation rushed to revise internal procedures to comply with the ruling about what a Chapter 13 trustee should do with the funds on hand when a bankruptcy case is converted from Chapter 13 to Chapter 7. Under the new ruling, the debtor is entitled to the return of any post-petition wages collected, but not yet distributed by the trustee.

Previous Handling of Post Petition Wages Collected When Chapter 13 Cases Converted to Chapter 7

Previously, it was assumed that part of a trustee’s duty when a Chapter 13 bankruptcy was converting to a Chapter 7 bankruptcy was to wrap things up by distributing all accessible funds to creditors. However, under the new ruling, the Chapter 13 trustee’s authority to service the estate terminates the moment the Chapter 13 converts to Chapter 7 bankruptcy. Bankruptcy code defines “making payments to creditors” as one of the core services handled by trustees, so the new ruling applies.

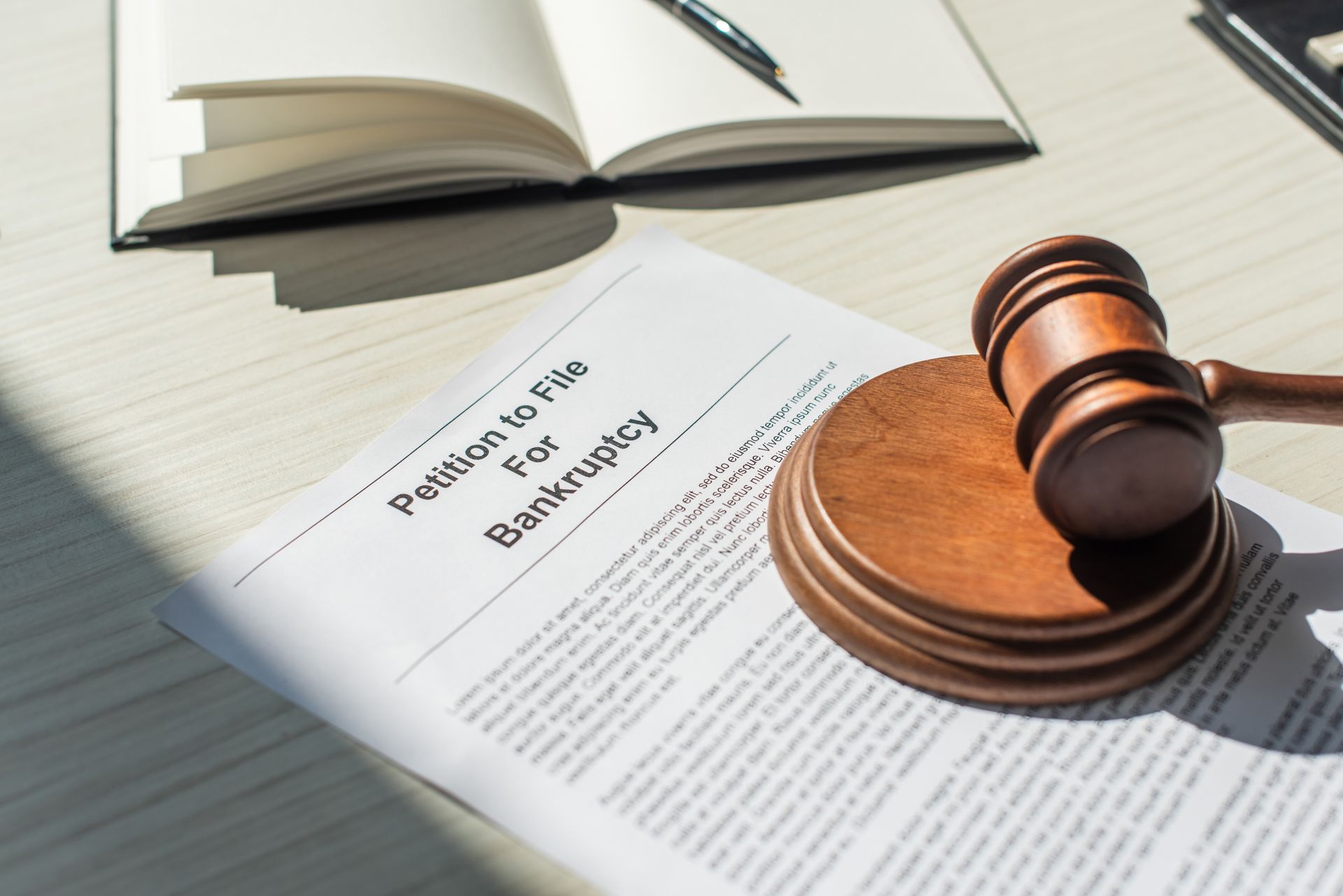

Other Findings of the Supreme Court in Harris v. Viegalahn:

- No provision in the bankruptcy code classifies any property, including post-petition wages, as belonging to creditors. Wages may be the property of the estate while the Chapter 13 proceeds, but estate property does not become creditors’ property until it is distributed to them.

- Any undistributed funds at the time a Chapter 13 bankruptcy case is converted to a Chapter 7 bankruptcy case are not the property of any creditor. Since the authority of the Chapter 13 trustee to perform services terminates at the moment of conversion, they can only return the petitioner’s funds.

- Funds that are traceable to the liquidation of a pre-petition asset are the sole exception to the above determination. In this case, the Bankruptcy Code allows the trustee to turn the undistributed funds over to the Chapter 7 trustee. On the other hand, if the funds are traceable to a post-petition asset, this ruling prevents Chapter 13 trustees from distributing the funds to creditors unless there is evidence of bad faith or Section 541(a)(5) referencing specific property acquired within 180 days of filing bankruptcy applies to the case.

Where Should the Balance on Hand Be Sent When a Chapter 13 Bankruptcy Case Converts to Chapter 7?

Wages on Hand: Return to the debtor (unless there is a showing of bad faith)

Liquidated Assets on Hand of Pre-Petition Asset: Turn over to Chapter 7 trustee

Liquidated Assets on Hand Post-Petition Asset: Return to the debtor (unless there is a showing of bad faith)

Attorney Fees Due per Confirmation Order: Funds returned to the debtor

Adequate Protection Payments Due Under the Chapter 13 Plan: Return to the debtor

Supreme Court rulings such as this one in Harris v. Viegalahn often result in ripples of decisions in the months and years to come, so we can expect additional questions, concerns, and issues to evolve.

If you have questions about converting a Chapter 13 bankruptcy to a Chapter 7 bankruptcy, please don’t hesitate to get in touch. Most bankruptcy offices in the Chattanooga area don’t have a single Consumer Bankruptcy Specialist on staff. Our office is the only one with two. You are in good hands with Kenneth C. Rannick P.C.

Schedule a Case Evaluation

Contact us now!

Homepage FCE Form

We will get back to you as soon as possible.

Please try again later.

By submitting this form, you agree to be contacted by our law firm, either by phone, text or by email.

Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Flexible Appointment Scheduling

24/7 Phone Availability

*$0 down to get your Chapter 7 case started applies to clients who choose to file a Chapter 7 bankruptcy with the U.S. Bankruptcy Court through Kenneth C. Rannick, P.C. We will open a Chapter 7 file for a client with as little as $0 down, however, our office will not file a client's Chapter 7 without an affordable down payment on attorney fees.

*$0 down to get your Chapter 13 case started applies to clients who choose to file a Chapter 13 bankruptcy with the U.S. Bankruptcy Court through Kenneth C. Rannick, P.C. Our law office will file a Chapter 13 without requiring any costs or attorney fees paid upfront for qualified clients who 1) have not had a prior chapter 13 dismissed within the past year, and 2) are not trying to stop a foreclosure within 20 days of filling bankruptcy.We are a debt relief agency.

We help people file for bankruptcy relief under the Bankruptcy Code.

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute an attorney-client relationship.

© Copyright 2023 | All Rights Reserved | Kenneth C. Rannick, P.C. | Powered By Convert It Marketing | Privacy Policy